BC Tax Assessments have been mailed out!

These Tax Assessment values are based on the Market Values determined by Provincial Tax Assessors for the purposes of determining what tax to charge a home owner. These are based on Market Values as of July 1, 2022.

The Tax Assessor takes into consideration characteristics including size, layout, shape, age, finish, quality, number of carports, garages, sundecks and condition of buildings.

The Tax Assessor does not physically visit the home. The information is based on past information and any permits that may have been acquired for the home over the year.

Furthermore, the sales data that is used for the evaluation is over a set period of time and is not relevant to current market conditions.

BC Assessment has advised homeowners that assessed values are likely higher than the current market values of their home. Most homeowners saw an increase in assess value from 5 – 15%.

Who uses the Tax Assessment value? The Provincial government and the Provincial government alone.

When a bank is looking at a refinancing or funding a mortgage for a property, they do not look at the Assessed Value. Nor do they look at the Assessed Value if granting a line of credit.

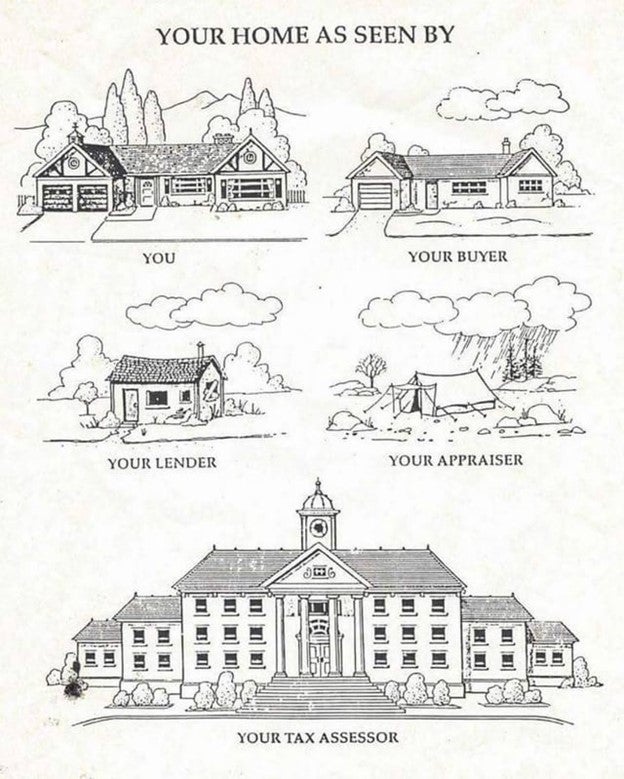

Appraisers do not use the Tax Assessment Value for any of their conclusions. Mortgage Brokers and RELATORs do not use it either.

This tool is used by the Province to assess you property taxes. It is not an accurate estimate of your home’s value.

To fully understand your home’s value, we must consider the current market conditions, recent sales, interest rates, renovations and more.

If you would like to know the Market Value for your home, please let me know. I would be happy to prepare a report for you that looks at the macro and micro economic conditions of the market and how it directly relates to you home.

This analysis can be used, should you want to challenge your Tax Assessment. It can be used to your own general knowledge. It can be used if you are thinking of making a move. It can be used to satisfy shear curiosity.